The First Party Coverage Cyber Insurance Market sector is undergoing rapid transformation, with significant growth and innovations expected by 2028. In-depth market research offers a thorough analysis of market size, share, and emerging trends, providing essential insights into its expansion potential. The report explores market segmentation and definitions, emphasizing key components and growth drivers. Through the use of SWOT and PESTEL analyses, it evaluates the sector’s strengths, weaknesses, opportunities, and threats, while considering political, economic, social, technological, environmental, and legal influences. Expert evaluations of competitor strategies and recent developments shed light on geographical trends and forecast the market’s future direction, creating a solid framework for strategic planning and investment decisions.

Brief Overview of the First Party Coverage Cyber Insurance Market:

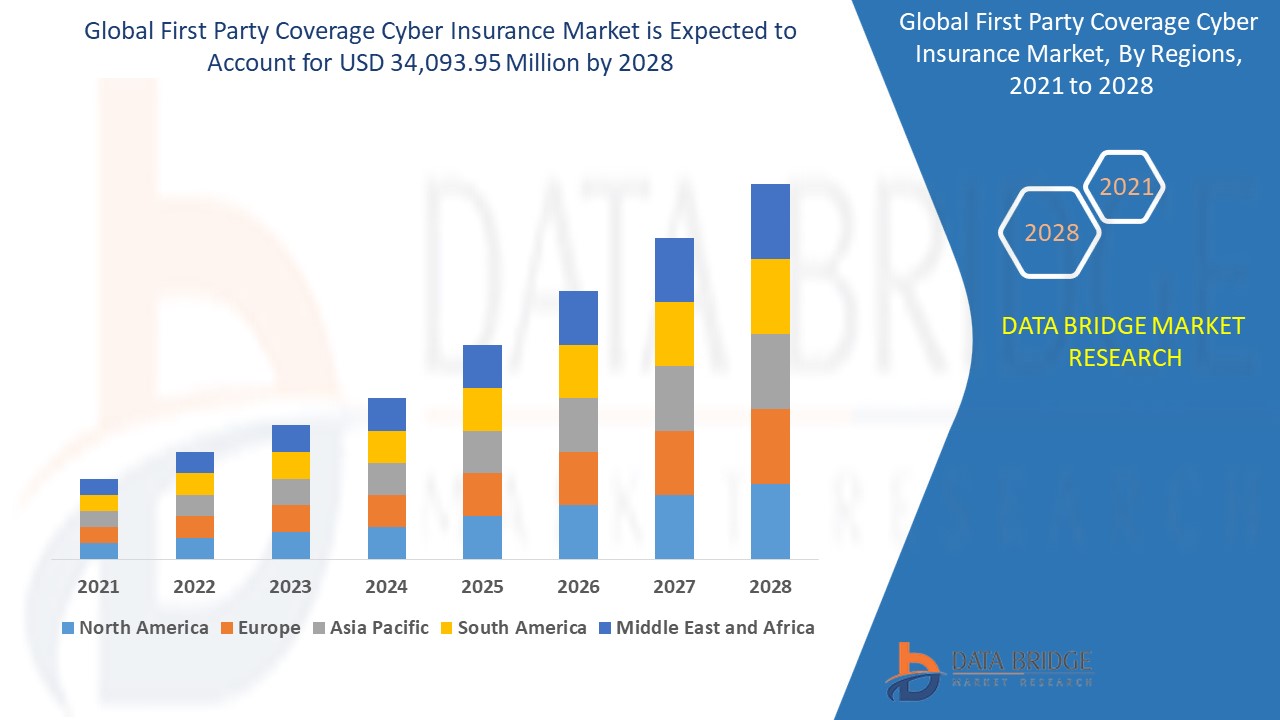

The global First Party Coverage Cyber Insurance Market is expected to experience substantial growth between 2024 and 2031. Starting from a steady growth rate in 2023, the market is anticipated to accelerate due to increasing strategic initiatives by key market players throughout the forecast period.

Get a Sample PDF of Report - https://www.databridgemarketresearch.com/request-a-sample/?dbmr=global-first-party-coverage-cyber-insurance-market

Which are the top companies operating in the First Party Coverage Cyber Insurance Market?

The report profiles noticeable organizations working in the water purifier showcase and the triumphant methodologies received by them. It likewise reveals insights about the share held by each organization and their contribution to the market's extension. This Global First Party Coverage Cyber Insurance Market report provides the information of the Top Companies in First Party Coverage Cyber Insurance Market in the market their business strategy, financial situation etc.

BitSight Technologies.; TAG CYBER AND REDSEAL; SecurityScorecard; Cyber Indemnity Solutions Ltd; Cisco; UpGuard, Inc.; Microsoft; Check Point Software Technologies Ltd.; AttackIQ.; SentinelOne; Symantec Corporation.; Accenture.; Kenna Security.; FireEye, Inc.; CyberArk Software Ltd.; Foundershield LLC; Chubb; AXA XL; American International Group, Inc.; The Travelers Indemnity Company

Report Scope and Market Segmentation

Which are the driving factors of the First Party Coverage Cyber Insurance Market?

The driving factors of the First Party Coverage Cyber Insurance Market are multifaceted and crucial for its growth and development. Technological advancements play a significant role by enhancing product efficiency, reducing costs, and introducing innovative features that cater to evolving consumer demands. Rising consumer interest and demand for keyword-related products and services further fuel market expansion. Favorable economic conditions, including increased disposable incomes, enable higher consumer spending, which benefits the market. Supportive regulatory environments, with policies that provide incentives and subsidies, also encourage growth, while globalization opens new opportunities by expanding market reach and international trade.

First Party Coverage Cyber Insurance Market - Competitive and Segmentation Analysis:

**Segments**

- By Type: On-premises, Cloud-based

- By Application: Large Enterprises, Small and Medium Enterprises (SMEs)

- By End-User: BFSI, IT and Telecom, Healthcare, Retail, Others

The global first-party coverage cyber insurance market is poised for significant growth between 2021 and 2028. Factors such as the rise in cyber threats and attacks, increasing adoption of cloud-based technologies, and stringent data protection regulations are driving the market forward. By type, the market is segmented into on-premises and cloud-based solutions. The cloud-based segment is anticipated to witness substantial growth during the forecast period due to its scalability, cost-effectiveness, and advanced security features. In terms of applications, the market caters to large enterprises and small and medium enterprises (SMEs). The increasing digitalization and connectivity among SMEs are expected to boost the demand for cyber insurance solutions. Furthermore, based on end-users, the market covers various sectors including BFSI, IT and Telecom, healthcare, retail, and others. The BFSI sector is likely to hold a significant market share owing to the high volume of sensitive financial data involved.

**Market Players**

- Chubb Limited

- AIG

- Allianz Group

- AXA

- Zurich Insurance Group

- Berkshire Hathaway

- Munich Re Group

- Lloyd's

- Lockton Companies

- Beazley Group

The global first-party coverage cyber insurance market is competitive and fragmented with several key players leading the industry. Companies such as Chubb Limited, AIG, and Allianz Group are prominent players in the market, offering a wide range of cyber insurance products and services. These companies focus on strategic partnerships, acquisitions, and product innovation to maintain their competitive edge in the market. Additionally, players like AXA, Zurich Insurance Group, and Berkshire Hathaway are investing heavily in research and development to enhance their cybersecurity solutions and stay ahead in the market. OtherThe global first-party coverage cyber insurance market is experiencing significant growth driven by various factors such as the increasing frequency and sophistication of cyber threats, growing adoption of cloud-based technologies, and the implementation of stringent data protection regulations. As organizations across different sectors face the evolving landscape of cyber risks, the demand for comprehensive cyber insurance solutions continues to rise. The market segmentation based on type into on-premises and cloud-based solutions highlights the shift towards more agile and scalable cybersecurity measures, with the cloud-based segment projected to witness substantial growth due to its cost-effectiveness and advanced security capabilities.

In terms of applications, the market caters to both large enterprises and small and medium enterprises (SMEs), with a particular focus on the increasing digitalization and cybersecurity needs of SMEs. The adoption of cyber insurance among SMEs is expected to accelerate as these businesses become more interconnected and leverage digital technologies to drive growth. The segmentation by end-users further sheds light on the diverse sectors benefiting from cyber insurance, with the BFSI sector standing out due to the high volume of sensitive financial data at stake. The reliance of financial institutions on digital platforms makes them prime targets for cyberattacks, underscoring the importance of robust insurance coverage to mitigate financial losses and reputational damage.

In the competitive landscape of the global first-party coverage cyber insurance market, key players such as Chubb Limited, AIG, and Allianz Group dominate the industry with their comprehensive offerings and strategic initiatives. These market leaders focus on collaboration with cybersecurity experts, acquisitions of specialized firms, and continuous product innovation to address evolving cyber risks effectively. Companies like AXA, Zurich Insurance Group, and Berkshire Hathaway are also investing heavily in research and development to enhance their cyber insurance solutions and stay ahead of the competition. The market players are not only aiming to expand their market presence but also to provide tailored cyber insurance products that cater to the specific needs of different industry verticals and company sizes.

Overall, the global first-party coverage cyber insurance market is witnessing robust growth propelled**Market Players**

- Chubb Limited

- AIG

- Allianz Group

- AXA

- Zurich Insurance Group

- Berkshire Hathaway

- Munich Re Group

- Lloyd's

- Lockton Companies

- Beazley Group

- BitSight Technologies

- TAG CYBER AND REDSEAL

- SecurityScorecard

- Cyber Indemnity Solutions Ltd

- Cisco

- UpGuard, Inc.

- Microsoft

- Check Point Software Technologies Ltd.

- AttackIQ.

- SentinelOne

- Symantec Corporation.

- Accenture.

- Kenna Security.

- FireEye, Inc.

- CyberArk Software Ltd.

- Foundershield LLC

- AXA XL

- American International Group, Inc.

- The Travelers Indemnity Company

The global first-party coverage cyber insurance market is thriving due to the increasing cyber threats, widespread adoption of cloud-based technologies, and stringent data protection regulations. The market is segmented based on type, application, and end-user, with cloud-based solutions expected to drive significant growth. Large enterprises and SMEs are both key market segments, with SMEs witnessing a surge in demand for cyber insurance due to digitalization. The BFSI sector is a major end-user due to the high volume of sensitive financial data, creating a substantial market opportunity for cyber insurance providers. The competitive landscape is led by key players like Chubb Limited, AIG, and Allianz Group, who prioritize innovation and

North America, particularly the United States, will continue to exert significant influence that cannot be overlooked. Any shifts in the United States could impact the development trajectory of the First Party Coverage Cyber Insurance Market. The North American market is poised for substantial growth over the forecast period. The region benefits from widespread adoption of advanced technologies and the presence of major industry players, creating abundant growth opportunities.

Similarly, Europe plays a crucial role in the global First Party Coverage Cyber Insurance Market, expected to exhibit impressive growth in CAGR from 2024 to 2028.

Explore Further Details about This Research First Party Coverage Cyber Insurance Market Report https://www.databridgemarketresearch.com/reports/global-first-party-coverage-cyber-insurance-market

Key Benefits for Industry Participants and Stakeholders: –

- Industry drivers, trends, restraints, and opportunities are covered in the study.

- Neutral perspective on the First Party Coverage Cyber Insurance Market scenario

- Recent industry growth and new developments

- Competitive landscape and strategies of key companies

- The Historical, current, and estimated First Party Coverage Cyber Insurance Market size in terms of value and size

- In-depth, comprehensive analysis and forecasting of the First Party Coverage Cyber Insurance Market

Geographically, the detailed analysis of consumption, revenue, market share and growth rate, historical data and forecast (2024-2031) of the following regions are covered in Chapters

The countries covered in the First Party Coverage Cyber Insurance Market report are U.S., copyright and Mexico in North America, Brazil, Argentina and Rest of South America as part of South America, Germany, Italy, U.K., France, Spain, Netherlands, Belgium, Switzerland, Turkey, Russia, Rest of Europe in Europe, Japan, China, India, South Korea, Australia, Singapore, Malaysia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA

Detailed TOC of First Party Coverage Cyber Insurance Market Insights and Forecast to 2028

Part 01: Executive Summary

Part 02: Scope Of The Report

Part 03: Research Methodology

Part 04: First Party Coverage Cyber Insurance Market Landscape

Part 05: Pipeline Analysis

Part 06: First Party Coverage Cyber Insurance Market Sizing

Part 07: Five Forces Analysis

Part 08: First Party Coverage Cyber Insurance Market Segmentation

Part 09: Customer Landscape

Part 10: Regional Landscape

Part 11: Decision Framework

Part 12: Drivers And Challenges

Part 13: First Party Coverage Cyber Insurance Market Trends

Part 14: Vendor Landscape

Part 15: Vendor Analysis

Part 16: Appendix

Browse More Reports:

Japan: https://www.databridgemarketresearch.com/jp/reports/global-first-party-coverage-cyber-insurance-market

China: https://www.databridgemarketresearch.com/zh/reports/global-first-party-coverage-cyber-insurance-market

Arabic: https://www.databridgemarketresearch.com/ar/reports/global-first-party-coverage-cyber-insurance-market

Portuguese: https://www.databridgemarketresearch.com/pt/reports/global-first-party-coverage-cyber-insurance-market

German: https://www.databridgemarketresearch.com/de/reports/global-first-party-coverage-cyber-insurance-market

French: https://www.databridgemarketresearch.com/fr/reports/global-first-party-coverage-cyber-insurance-market

Spanish: https://www.databridgemarketresearch.com/es/reports/global-first-party-coverage-cyber-insurance-market

Korean: https://www.databridgemarketresearch.com/ko/reports/global-first-party-coverage-cyber-insurance-market

Russian: https://www.databridgemarketresearch.com/ru/reports/global-first-party-coverage-cyber-insurance-market

Data Bridge Market Research:

Today's trends are a great way to predict future events!

Data Bridge Market Research is a market research and consulting company that stands out for its innovative and distinctive approach, as well as its unmatched resilience and integrated methods. We are dedicated to identifying the best market opportunities, and providing insightful information that will help your business thrive in the marketplace. Data Bridge offers tailored solutions to complex business challenges. This facilitates a smooth decision-making process. Data Bridge was founded in Pune in 2015. It is the product of deep wisdom and experience.

Contact Us:

Data Bridge Market Research

US: +1 614 591 3140

UK: +44 845 154 9652

APAC: +653 1251 1364

Email:- [email protected]